Experience peace of mind with a fixed-rate mortgage. Lock in your interest rate and enjoy predictable monthly payments throughout the life of your loan.

Fixed-rate Mortgages

What is a fixed-rate mortgage

Stable payments

Your monthly payment amount stays the same throughout the life of your loan, providing peace of mind and budget stability.

Stable payments

Fixed-rate mortgages offer the potential for significant long-term savings, allowing you to save money over the life of your loan.

Predictable interest rates

With a fixed-rate mortgage, your interest rate stays the same, allowing you to accurately forecast your long-term mortgage payments.

Flexible loan terms

Choose from a variety of loan terms, such as 15-year, 20-year, and 30-year options, to best suit your financial needs and goals.

A fixed-rate mortgage is a type of home loan that has a fixed interest rate and monthly payment for the entire term of the loan. This means that your interest rate and payment will never change, giving you peace of mind and predictability. Fixed-rate mortgages are a popular choice for those who want to budget and plan for their mortgage payments over the long term.

Fixed-rate Mortgages

Eligibility criteria

To qualify for a fixed-rate mortgage, you’ll need to meet certain eligibility requirements, such as having a good credit score, a stable income, and a low debt-to-income ratio. We’ll outline the eligibility criteria and help you determine if a fixed-rate mortgage is the right choice for you.

Eligibility Requirements for Fixed-Rate Mortgages

Minimum credit score: A minimum credit score is required to qualify for a fixed-rate mortgage, typically around 620 or higher.

Income: Borrowers must have a stable income that is sufficient to cover their mortgage payments and other monthly expenses.

Employment history: Lenders will want to see a stable employment history, typically at least two years with the same employer.

Debt-to-income ratio: Borrowers’ debt-to-income ratio, which is the ratio of their monthly debt payments to their monthly income, must be within an acceptable range.

Down payment: Borrowers are usually required to make a down payment of at least 5% to 20% of the home’s purchase price.

Fixed-rate Mortgages

Features and benefits

Fixed-rate mortgages offer several key benefits, including stable payments, predictable interest rates, and long-term savings. With a fixed-rate mortgage, you’ll always know what your payment will be, making it easier to budget for other expenses. Additionally, if interest rates rise, your fixed rate won’t change, saving you money over the long term.

+25%

Rate as low as

6-60 months

Term

$100K-$20M

Amount

2-3 Weeks

Time to Fund

Fixed-rate Mortgages

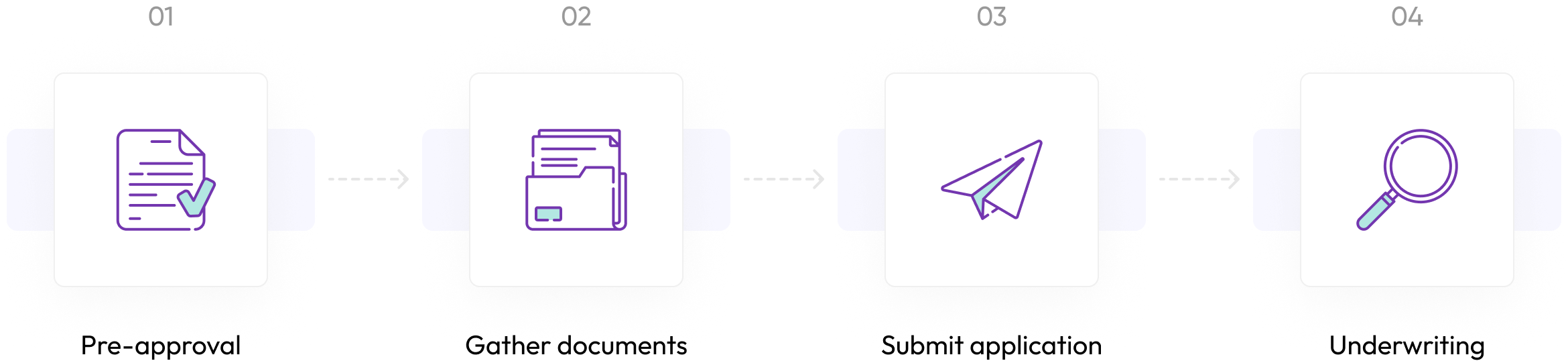

Application process

Applying for a fixed-rate mortgage can seem overwhelming, but we’ll guide you through the process step-by-step. We’ll explain what documents you’ll need to provide and what to expect during the underwriting process. Our goal is to make the application process as easy and stress-free as possible, so you can focus on finding your dream home.

Testimonials

Hear from our satisfied customers

Here’s what some of our satisfied clients have to say about working with LoanGeek:

“They were friendly, professional, and went above and beyond to make sure I understood every step of the process. Thanks to LoanGeek, I was able to secure financing for my real estate project and turn my dreams into a reality.”

Linda M. Duran

Charlotte, NC

Jacob S. Chapman

Benton, KY

“They were friendly, professional, and went above and beyond to make sure I understood every step of the process. Thanks to LoanGeek, I was able to secure financing for my real estate project and turn my dreams into a reality.”

Linda M. Duran

Charlotte, NC

Jacob S. Chapman

Benton, KY

Newsletter

Subscribe to our newsletter

We care about your data in our privacy policy.